GPIF and AfDB launch initiative to promote Green and Social Bonds

October, 10, 2019

Government Pension Investment Fund (GPIF) and African Development Bank (AfDB) have started a partnership that aims to strengthen capital market cooperation to promote ESG integration into fixed income investment.

African Development Bank (AfDB) issues Green and Social Bonds that align with the International Capital Market Association (ICMA) Green bond Principles and Social bond Principles that contribute to make a sustainable society. Investment opportunities into these bonds will be provided to GPIF's asset managers.

<Comment by Hiro Mizuno, Executive MD and CIO of GPIF>

GPIF demand our asset managers to integrate ESG into their investment process from analysis to investment decision. We regard the purchase of Green, Social and Sustainability Bonds as one of the direct methods of ESG integration in the fixed income investment. GPIF wish to contribute to make Green, Social and Sustainability bonds mainstream investment products in order to ensure the sustainable performance of the pension reserve fund for all the generations.

<Comment by Akinwumi Ayodeji Adesina, President of the African Development Bank Group>

I am delighted that the Government Pension Investment Fund, the world's largest pension fund for the promotion of sustainable investment, is partnering with the African Development Bank. This landmark strategic partnership will help to catalyze investment capital, create more sustainable investments and support the African Development Bank to achieve its High 5 priorities to fast-track Africa's development.

<Comment by Hassatou Diop N'Sele, Treasurer of the African Development Bank Group>

The African Development Bank is very pleased to partner with an exceptional investor, whose commitment to developing the SRI market is truly aligned with the Bank's mission. Changing people's lives is at the core of the Bank's work and with GPIF we will be investing in Africa's future.

<Link to ICMA's Principles and Guidelines for Green, Social and Sustainability Bonds>

https://www.icmagroup.org/green-social-and-sustainability-bonds/

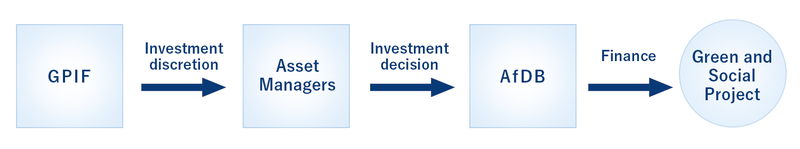

<Investment Scheme>