GPIF and IsDB launch initiative to promote Green and Sustainable Sukuk

December, 6, 2019

Government Pension Investment Fund (GPIF) and Islamic Development Bank (IsDB) have recently formed a partnership to promote and develop sustainable capital markets through a focus on Green and Sustainable Sukuk, as well as the incorporation of ESG assessments in fixed income investments.

IsDB's Green and Sustainable Sukuk are issued in alignment with the Green Bond Principles, Social Bond Principles and Sustainability Bond Guidelines, which are administered by the International Capital Market Association (ICMA). These bonds provide investment opportunities for GPIF asset managers to contribute to make a sustainable society.

<Comment by Hiro Mizuno, Executive MD and CIO of GPIF>

GPIF requires our asset managers to integrate ESG into their investment processes from analysis to the investment decision. We regard the purchase of Green and Sustainable Sukuk as one of the direct methods of ESG integration. GPIF looks forward to contributing to the development of the region through this program.

<Comment by Dr. Zamir Iqbal, Vice President and CFO of IsDB>

This partnership with the GPIF reaffirms our commitment to provide opportunities for Socially Responsible Investments (SRI) and ESG investors like GPIF to deliver sustainable development to our member countries through Green and responsible finance. IsDB lauds the pathbreaking efforts of GPIF for their contribution to development of our Member Countries.

<Comment by Dr. Yasser Gado, IsDB Treasurer>

GPIF is the world's largest pension fund in terms of Assets under Management (AuM) and it strongly promotes sustainable investments. In this context, IsDB is a natural partner for this initiative that will catalyze investments into the ESG fixed-income space and further develop the SRI markets.

<What is Sukuk?>

Sukuk commonly refers to the Islamic equivalent of bonds. However, as opposed to conventional bonds, which merely confer ownership of a debt, Sukuk grants the investor a share of an asset, along with the commensurate cash flows and risk. As such, Sukuk securities adhere to Islamic laws sometimes referred to as Shari'ah principles. Sukuk was proven to easily fit into the current fixed income and bond system infrastructure and is already acceptable to many conventional fixed income security investors.

<Link to the Principles and Guidelines for Green, Social and Sustainability Bonds>

https://www.icmagroup.org/green-social-and-sustainability-bonds/

<Link to details on Sukuk>

https://www.isdb.org/news/isdb-announces-plans-to-launch-first-green-bond

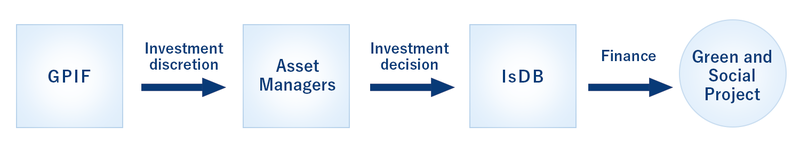

<Investment Scheme>