Report of the 9th Survey of Listed Companies Regarding Institutional Investors' Stewardship Activities

The Government Pension Investment Fund (GPIF) has conducted surveys targeting listed companies every year in order to evaluate the stewardship activities carried out by GPIF's external asset managers. The survey also seeks to ascertain the actual status of, and changes in "purposeful and constructive dialogue" (engagement) between these companies and asset managers. The results of this year's survey were announced as follows.

- Outline of the Survey

■ Subjects: 2,154 TOPIX component companies (as of December 18, 2023)

■ Number of respondent companies: 717 (735 in the previous survey)

■ Response rate : 33.3% (34.0% in the previous survey)

■ Survey period: From January 18 through March 22, 2024

- Comments from Masataka Miyazono, President of GPIF

We again received responses from a very large number of companies for this ninth survey. We would like to take this opportunity to thank all the companies that took the time out of their busy schedule to participate in this survey and provide us with valuable comments and opinions.

For this survey, we added new questions such as "Regarding the Tokyo Stock Exchange's request to take 'Action to Implement Management that is Conscious of Cost of Capital and Stock Price,'" "Specific content and impressions of dialogue with outside directors," "Status of discussion on ESG and sustainability at board of directors meetings," and "Regarding the Task Force on Nature-related Financial Disclosures (TNFD)."

Regarding "Action to Implement Management that is Conscious of Cost of Capital and Stock Price," most companies have been working on these measures following a request from the Tokyo Stock Exchange last year, but many companies feel there are issues in considering how to respond. In addition to these issues, the survey also covers what companies expect from investors. We have also presented some highly evaluated cases of engagement by GPIF's asset managers entrusted with domestic equity investment. We hope that asset managers will find these expectations for investors and evaluations useful.

Furthermore, many companies responded that they would like to cooperate in our interviews and other activities to understand the actual state of dialogue conducted by our asset managers.

Referring to the responses to this survey and the results of interviews, GPIF will continue to further promote its stewardship activities and ESG initiatives.

- Main Topics of This Survey

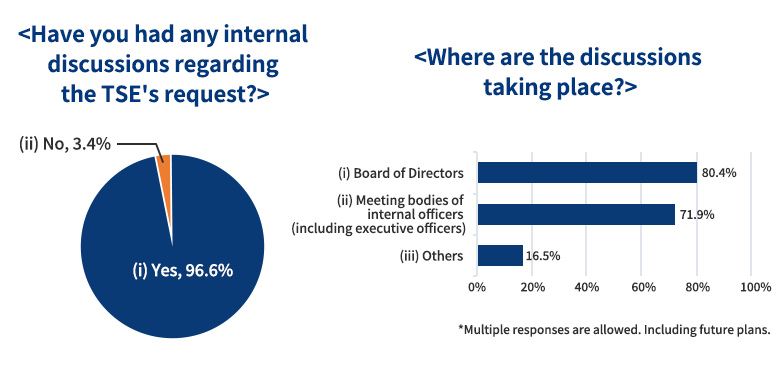

1.Impact of the Tokyo Stock Exchange's request to take "Action to Implement Management that is Conscious of Cost of Capital and Stock Price"

In this survey, a new question was added regarding the Tokyo Stock Exchange's request to take "Action to Implement Management that is Conscious of Cost of Capital and Stock Price." Almost all companies have discussed this request internally, and of those, as many as 80% have discussed or plan to discuss it at their board of directors' meetings. Among institutional investors, the status of use of corporate governance reports, etc. suggests that dialogue on this topic has already become active. On the other hand, companies are aware of various issues when considering how to respond to these requests. These issues are: 1) internal dissemination; 2) calculation of cost of capital; 3) matters to be disclosed; 4) specific measures to be taken; and 5) gap with investors. Additionally, many companies have expressed their expectations for dialogue with investors, and it is expected that constructive dialogue will progress based on the issues faced by companies.

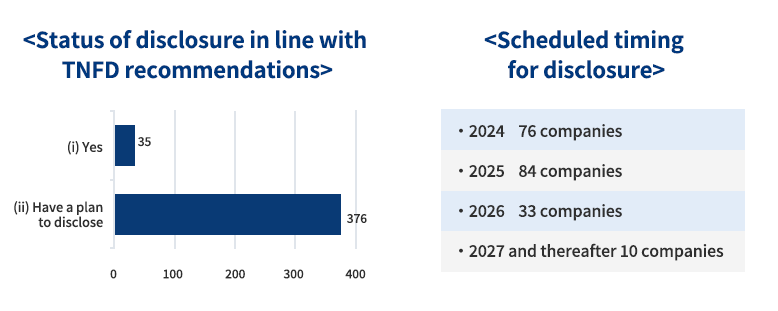

2.Status of response to the Task Force on Nature-related Financial Disclosures (TNFD)

In previous surveys, we asked about the status of response to the Task Force on Climate-related Financial Disclosures (TCFD). This time, however, we added a new question about the status of response to the Task Force on Nature-related Financial Disclosures (TNFD). Since the TNFD's final recommendations were published in September last year, the number of companies disclosing information in line with the TNFD is considerably smaller compared to the TCFD. However, many companies responded that they planned to disclose information in line with the TNFD recommendations in the future, suggesting that the number of companies disclosing information is expected to increase.